During credit card sales pitches, many salespeople typically follow a similar pattern. Introducing themselves and their bank, then asking prospects if they need a credit card. However, this frequently leads to prospects promptly rejecting the offer and ending the call. If you’re facing similar responses, it’s time to adjust your approach and effectively persuade your customers.

While there’s no guarantee of making a sale, you can enhance your persuasive techniques by utilizing proven tactics, frameworks, and best practices. These methods can help create a favourable impression of your credit card, potentially influencing customers’ decisions positively. However, the first step is to pinpoint the underlying issues causing your sales pitch to falter and prevent successful credit card sales. Let’s start by addressing these challenges head-on.

Why your sales pitch doesn’t work?

As a salesperson, it can be frustrating when your pitch doesn’t seem to work, especially in the case of credit card selling. You may have all the right information and talking points, but sometimes you just can’t seal the deal. There are several reasons why this might happen, and understanding them is crucial for improving your success rate.

Timing is everything in sales. If you call or approach a potential customer at an inconvenient time, they will likely brush off your pitch without giving it much thought. For example, if someone is busy with something else or having a bad day already. They may not be in the mindset to consider new offers. This could also apply to emails or direct mail campaigns that get lost among hundreds of other messages in their mailbox. It’s important to research and understand your target audience’s schedule before reaching out. So that your message has a better chance of being received positively.

In order for a sale to take place successfully. There needs to be effective communication between both parties involved. You as the seller and the potential customer as the buyer. However, sometimes our conversations can miss the mark due to misunderstandings. For instance, if you are speaking too quickly or using technical jargon that your contact does not understand. They may become disinterested and lose focus on what you’re trying to sell them. It’s crucial to tailor your conversation based on who you’re talking to. So that they fully comprehend what you’re offering and how it benefits them.

One common mistake many salespeople make is jumping straight into their pitch without building any rapport with their contact first. This comes across as pushy and insincere which immediately turns people away from considering anything further from you. Instead of launching straight into “buy now” mode, start by building a relationship with your potential customer. Ask them about their needs and goals, listen to what they have to say, and then offer solutions that align with their interests.

Not giving enough context can also lead to confusion for both parties involved. If the purpose of your call isn’t clear from the beginning, misunderstandings can arise during further discussions which can ultimately result in losing potential customers. Moreover, not providing enough context shows disrespect towards prospects’ time and privacy. People generally don’t appreciate being contacted by strangers without knowing why they’re being called or how their personal information was obtained.

Best practices to convince your customers to buy your credit cards

Here are some convincing ways to align with the identified problems and additional strategies to persuade customers to buy your credit cards:

1. Understand the customer’s schedule before reaching out

When it comes to selling credit cards, understanding your customer’s schedule should be one of your top priorities. Knowing their schedule allows you to reach out at an appropriate time. This not only shows respect for their busy lives. But also increases the chances of them being receptive to your pitch.

Imagine calling someone during their work hours when they are swamped with tasks. Do you think they would have the patience or interest to listen to what you have to say?

By understanding their schedule beforehand, you can avoid such scenarios and ensure that your message is received positively.

Besides, knowing their schedule, you can tailor your approach accordingly. For example, if your target audience consists mostly of working professionals who are always on the go. Providing information through emails or online platforms might be more effective. Then setting up face-to-face meetings which may disrupt their daily routine.

Moreover, understanding your customer’s schedules gives insight into specific times when they may need a credit card. For instance, if they mention having upcoming travels or major purchases planned shortly during a conversation about scheduling appointments with them. This could present an opportunity for promoting travel benefits or installment plans offered by the credit card company.

For this strategy to be successful though, proper research and preparation must be done prior to reaching out. Keep track of important dates such as holidays or events that may affect your customers’ schedules so that you can plan and make timely follow-ups.

It will show your professionalism and consideration towards them which helps build trust between both parties. Furthermore, it will set a positive tone from the start of your sales pitch and increase the likelihood of a successful sale. So remember, before reaching out to potential customers for credit card sales, take the time to understand their schedules. It will make all the difference in your approach and ultimately lead to higher conversion rates.

2. Make sure your opening conversation delivers proper context and value

Customers are bombarded with numerous sales pitches every day. Making them skeptical about any new product or service being offered to them. So without enough context, the customer may feel annoyed by the call. Therefore, providing context in a sales pitch is crucial: it helps in building trust and credibility with potential customers. Let’s consider an example of how you can start your sales pitch:

“Hi there! My name is Sarah from ABC company. We recently attended a networking event where we had some great conversations about [product/service]. One of our mutual connections recommended that I reach out to you as they think our [product/service] could benefit your business as well.”

By providing specific details about how you obtained the prospect’s information and mentioning a mutual connection who referred them. Here you have established credibility and built rapport with the potential customer right away.

This types of approach increase the chances of making a successful sale compared to someone who simply jumps straight into their pitch without giving any background information. To add more value to this sales pitch. Instead of simply stating “We offer great rewards on our credit card,”. You can try saying something like “Our credit card offers exclusive discounts at your favorite restaurants” if you know your target audience loves dining out.

3. Start the conversation by asking open-ended questions to understand the customer’s needs and goals

Asking open-ended questions is crucial in the sales process, especially when trying to convince customers to buy a credit card. For example, if a customer mentions that they travel frequently for work or leisure, you could ask them what type of rewards or benefits would be most appealing to them.

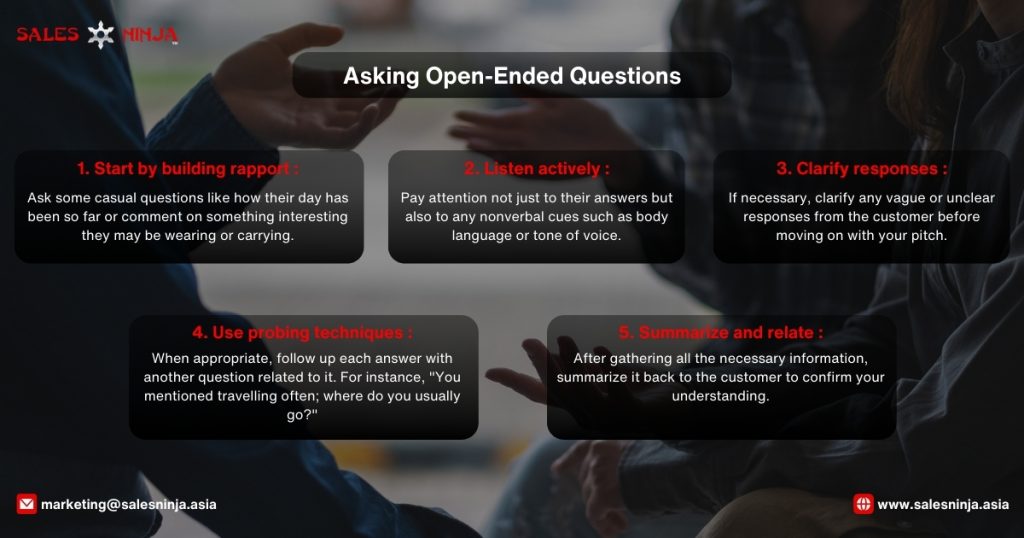

To effectively use this technique during sales conversations, certain steps should be followed:

1) Start by building rapport: Before jumping into selling mode, it is important to establish a connection with the customer. Ask some casual questions like how their day has been so far or comment on something interesting they may be wearing or carrying.

2) Listen actively: As you ask open-ended questions, make sure you listen carefully and take notes if needed. Pay attention not just to their answers but also to any nonverbal cues such as body language or tone of voice.

3) Clarify responses: If necessary, clarify any vague or unclear responses from the customer before moving on with your pitch. This ensures both parties are on the same page and avoids misunderstandings later on.

4) Use probing techniques: When appropriate, follow up each answer with another question related to it. For instance, “You mentioned traveling often; where do you usually go?” These probing questions help dig deeper into understanding the customer’s desires and preferences.

5) Summarize and relate: After gathering all the necessary information, summarize it back to the customer to confirm your understanding. This also allows you to connect their needs with the features of the credit card, making it more relevant and appealing.

5# Offer a trial period or a demo of the credit card’s features to allow the customer to experience its benefits firsthand before committing

Offering a trial period or demo of the credit card’s features can help in convincing your customers to buy the credit card. Because they can see for themselves how it can improve their financial management and simplify their transactions. Moreover, this approach also addresses any doubts or concerns that potential customers may have about investing in a new credit card.

It shows that your company is confident enough to let people test it out before making a commitment. To take advantage of this opportunity, all potential customers need to do is sign up for the trial period or attend your demo session. From there, they can explore the various features and benefits of the credit card at no cost or obligation. By trying it out for themselves, customers can make an informed decision on whether or not the credit card meets their needs.

6. Address any potential concerns or questions proactively to ensure the customer feels informed and confident in their decision

This approach allows us to address any misconceptions or negative perceptions that the customer may have about credit cards. You can explain how your company’s credit card offers unique benefits. Such as cashback rewards or low interest rates compared to other options in the market.

Moreover, by providing proper insights and logical reasoning behind why getting a credit card would be beneficial for them. You are building trust with your target audience. In addition, using a direct tone when communicating with your target audience can further strengthen your message.

Instead of simply listing off facts about the credit card. Tell them what they need to know specifically based on their individual needs and preferences. For example, if someone is concerned about overspending with a new line of credit. Reassure them by explaining how responsible spending habits combined with timely payments can improve their overall financial health.

Overall, addressing potential concerns proactively not only helps convince customers. But also builds long-term relationships by instilling confidence in their purchase decisions.

7. Offer personalized recommendations based on the customer’s spending habits or financial goals to demonstrate the card’s relevance and value to their specific needs

Think about it from the customer’s perspective – they want a credit card that fits their individual needs and lifestyle. By understanding their spending habits and financial goals, you can tailor your pitch to show how this particular credit card will benefit them in ways that other generic offers cannot.

To put this into action, start by getting to know your customers (we have mentioned earlier too!) through conversations or surveys. Then use this information to craft personalized recommendations showcasing how the features of this specific card align with their desires. Besides, use personalized language such as ‘you’ rather than ‘customers’. It creates a sense of direct communication and makes the customer feel valued.

Remember, every customer is different – what works for one may not work for another. That’s why tailoring your approach based on each individual’s needs creates a more compelling argument. For why they should choose this particular credit card over others in the market.

Training can further enhance your expertise in persuading customers

Corporate training can play a significant role in enhancing your expertise in this area. One key benefit of receiving professional training is that it exposes you to new strategies and techniques that you may not have previously considered. These could include effective communication methods, understanding customer psychology, or even specific tactics for building rapport with potential clients.

By learning these approaches from experienced trainers. You will gain valuable insights into how best to approach each unique situation when attempting to convince someone to purchase a credit card. Moreover, corporate training provides a safe space where individuals can practice their persuasion skills without fear of failure or rejection.

This allows participants to experiment with different styles and receive constructive feedback from experts who understand the nuances of salesmanship. As they say, “Practice makes perfect,”. So taking part in regular training sessions can ultimately lead to substantial growth and improvement in one’s capabilities as a persuasive seller. At Sales Ninja, we specialize in providing top-notch corporate training programs designed specifically for professionals looking to enhance their skills in persuading customers.

Our team consists of highly experienced trainers who use innovative teaching methods tailored towards improving individual performance levels. If you are interested in further developing your abilities as a convincing salesperson and want guidance from seasoned experts, do not hesitate to reach out to us at Sales Ninja today! We guarantee that our customized training programs will equip you with all the necessary tools needed for success in driving more credit card purchases than ever before.

Leave A Comment