If you’re working in the insurance sector, finding ways to increase insurance sales is likely a top priority. But how do you transition from simply meeting sales goals to surpassing them easily? The secret lies in your approach and understanding the underlying strategies that lead to successful sales. So, here are 15 straightforward steps to supercharge your insurance sales. Ready to kick your sales into high gear? Let’s jump in!

Know Who You’re Selling To

Understanding your audience is the foundation of any successful sales strategy. To sell insurance effectively, you need to know who your potential customers are, what they care about, and what their specific needs might be. Think about it—how can you provide the right solutions if you don’t understand the problems your clients face?

Start by gathering information on their demographics, lifestyle, and financial situation. Are they young professionals just starting their careers, or are they families looking for comprehensive coverage? Maybe they’re nearing retirement and need something entirely different. The more you know, the better you can tailor your pitch to resonate with their specific concerns.

Once you have a clear picture, adjust your approach. Speak their language, address their worries, and position your insurance offerings as the perfect solution to their unique needs. This personalized approach not only builds trust but also increases your chances of closing the sale.

Focus on Educating, Not Just Selling

You need to shift your mindset from simply selling insurance to educating your clients about what they need if you want to increase insurance sales. When you focus on educating rather than just pushing a sale, you’re building a relationship based on trust and understanding. Clients are more likely to buy from someone who they feel genuinely cares about their well-being, not just someone who is trying to meet a quota.

Take the time to explain how different insurance products work, what they cover, and why they might be beneficial. Break down complex terms into simple language that your clients can easily grasp. This approach not only empowers them to make informed decisions but also positions them as a knowledgeable and trustworthy advisor.

By prioritizing education, you create a more meaningful connection with your clients. They’ll appreciate the effort you’ve put into helping them understand their options, which can lead to more loyal customers and, ultimately, more sales.

Make Sure You Know Your Products Inside and Out

If you want to increase insurance sales, you need to deeply understand the products you’re offering. When you know your products inside and out, you can confidently answer any questions your clients may have, helping them see the value in what you’re selling. This kind of knowledge builds trust and credibility, making clients more likely to choose you as their insurance provider. So, take the time to study your products, understand their benefits, and be prepared to explain how they meet your client’s needs.

Showcase Success Stories to Build Trust

You need to leverage social proof to make your insurance sales strategy more effective. Testimonials and case studies are powerful tools that can influence potential buyers by showing them real-life success stories. When prospects see how others have benefited from your insurance products, they’re more likely to trust you and feel confident in their decision to buy. Sharing stories of satisfied customers helps to build credibility and can be the nudge someone needs to take the next step with you. So, don’t just tell them about your services—show them how you’ve made a difference for others.

Listen Actively to Uncover True Client Needs

When you genuinely listen to your clients, you go beyond just hearing their words—you start to understand their real needs and concerns. This deeper understanding allows you to provide better, more tailored solutions, which can ultimately increase insurance sales.

Start by giving your full attention during conversations. Avoid interrupting or thinking about your response while the client is speaking. Instead, focus on their words, tone, and body language. This will help you pick up on nuances and underlying issues that might not be immediately obvious.

Ask open-ended questions to encourage clients to share more about their needs and worries. This not only shows that you care but also gives you valuable insights into what they’re looking for. Use this information to tailor your insurance recommendations to meet their specific needs, enhancing your service and increasing the likelihood of a successful sale.

By making active listening a priority, you build stronger relationships with clients and offer them solutions that truly address their concerns, leading to more effective and successful sales outcomes.

Use Technology to Streamline Your Sales Process

To stay ahead, make sure you’re using tools that can simplify and enhance your sales operations. Start by integrating Customer Relationship Management (CRM) tools into your workflow. These systems help you keep track of client interactions, manage leads, and analyze customer data—all in one place. With a CRM, you can automate routine tasks, such as follow-up emails and reminders, freeing up more time to focus on building relationships.

Even don’t overlook the power of mobile apps. Many apps are designed to help you access client information, process quotes, and even close deals on the go. This mobility ensures you’re always equipped to respond to client needs swiftly, no matter where you are.

Additionally, explore other technologies like sales analytics tools and digital marketing platforms. These can provide insights into customer behavior and market trends, helping you make informed decisions and refine your sales strategies.

Tailor Insurance Solutions to Each Client

To truly stand out in the insurance market, you must offer solutions that fit each client’s unique needs. Instead of presenting a one-size-fits-all policy, focus on customizing your offerings based on the individual profiles of your clients.

Begin by gathering detailed information about each client—understand their specific needs, preferences, and financial situation. This might include their current coverage, future goals, and any concerns they have about their insurance. With this information, you can craft personalized insurance solutions that address their exact requirements.

This approach not only enhances customer satisfaction but also builds stronger relationships, leading to increased trust and higher chances of closing the sale, ultimately helping you increase insurance sales.

Make Timely Follow-Ups a Priority

Following up promptly is crucial for keeping potential clients engaged and moving through the sales process. When you reach out quickly after an initial contact or meeting, you demonstrate your commitment and interest, which can significantly boost your chances of closing the sale.

Think about it this way: a timely follow-up shows that you’re attentive and proactive. It helps keep the conversation fresh in the client’s mind and shows that you’re serious about addressing their needs. On the other hand, delays can make you seem disinterested or less organized, which might push potential clients toward your competitors.

To make this strategy work, set reminders to follow up after meetings, calls, or inquiries. Use these touchpoints to address any questions, provide additional information, or offer solutions to any concerns they might have. This ongoing engagement keeps the relationship strong and helps move the sale forward.

Address Concerns with Confidence

Handling objections effectively is crucial for boosting insurance sales. When a potential client raises a concern, it’s an opportunity to address their needs and demonstrate your expertise. First, listen carefully to what they’re saying. Understanding their objection fully is key to offering a well-thought-out response.

Be prepared with clear, concise answers that directly address their concerns. For instance, if they’re worried about the cost, explain how your insurance plan offers long-term value and protection. Show empathy and acknowledge their feelings—this builds trust and shows that you’re not just trying to make a sale, but genuinely want to help them find the right solution.

Practicing these techniques helps you respond confidently and professionally. Over time, this will ultimately help you increase insurance sales as you become more adept at turning objections into opportunities for growth.

Build Your Network Every Day

Networking is crucial for expanding your client base and increasing insurance sales. The more people you connect with, the more opportunities you create for yourself.

Start by attending industry events, joining local business groups, and participating in community activities. Each interaction is a chance to meet potential clients and establish your presence in the industry. Don’t limit your networking to just one-time encounters. Follow up with the people you meet, maintain regular contact, and nurture these relationships over time.

Networking is an ongoing process, and the connections you make today can lead to significant sales opportunities in the future.

Use Content to Educate and Attract Your Customers

Create engaging blogs, informative articles, and compelling videos that address your potential customers’ concerns and questions. Think about it—customers are more likely to engage with and purchase from someone who provides useful information and shows genuine expertise. Use your content to address common questions, explain complex insurance concepts, and showcase the real-life benefits of your offerings.

Regularly updating your content helps keep your audience informed and engaged. It builds trust and keeps your business top of mind when they’re ready to make a decision. So, start crafting content that speaks directly to your customers’ needs and watch how it attracts and converts them.

Keep Up with Industry Changes

Staying updated on industry trends is essential for boosting your insurance sales. The insurance market is always evolving—new regulations, emerging risks, and innovative products can all impact your offerings. To increase insurance sales, you need to stay ahead of these changes and understand how they affect what you’re selling.

Regularly review industry news, attend relevant conferences, and engage with professional networks to keep your knowledge fresh. This will help you anticipate market shifts and adapt your strategies accordingly. For example, if there’s a new regulation affecting coverage options, you can inform your clients about how it impacts their policies.

This proactive approach shows that you’re a knowledgeable and reliable advisor, which can significantly increase your chances of making a sale.

Deliver Exceptional Customer Service to Build Loyalty

Outstanding customer service is a game-changer in the insurance industry. It’s not just about addressing a client’s current needs; it’s about creating an experience that makes them want to come back and refer others to you. Imagine a client feeling so well cared for that they can’t help but tell their friends and family about the excellent service they received.

Start by being responsive and attentive. Answer questions promptly, provide clear and helpful information, and go the extra mile to resolve issues. Show empathy and understanding, making sure clients feel valued and supported throughout their journey with you.

This approach not only helps in retaining clients but also encourages them to recommend your services to others, generating valuable referrals.

Set Achievable Goals and Track Your Progress

Setting realistic sales goals is crucial for driving success in insurance sales. Start by defining targets that are both ambitious and attainable, giving your team clear objectives to aim for. Remember, goals should be challenging enough to inspire effort but not so unrealistic that they become discouraging.

Once you’ve set these goals, it’s important to track your progress regularly. Keep an eye on how close you are to meeting your targets and adjust your strategies as needed. This ongoing assessment helps you stay focused and motivated and allows you to make informed decisions to improve your approach.

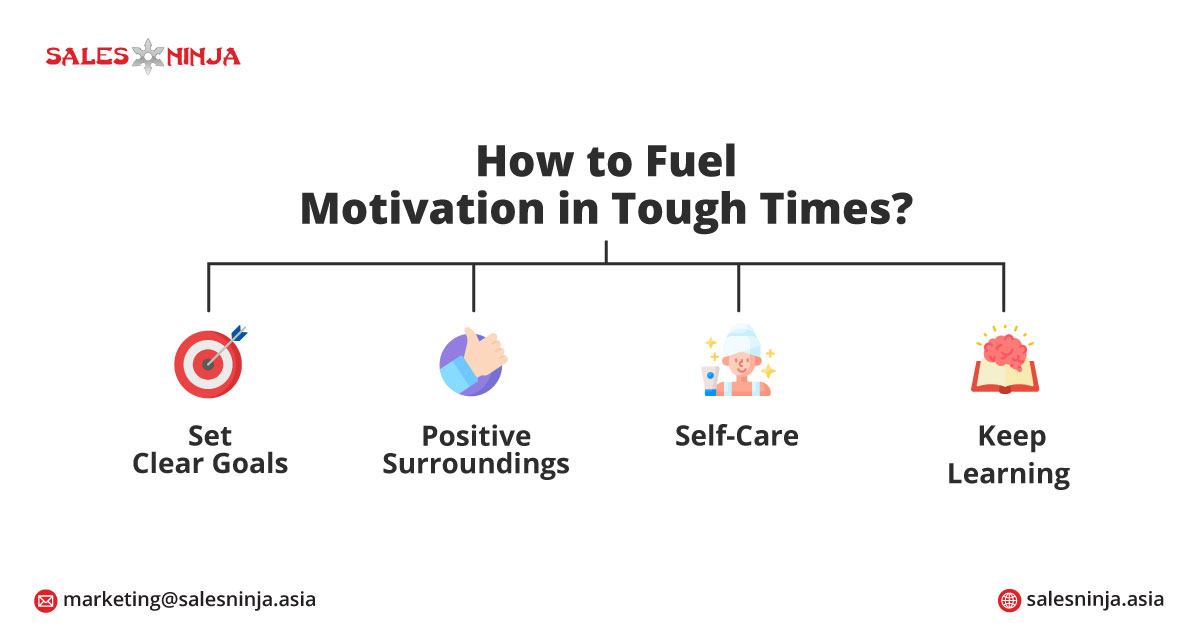

Keep Your Drive Alive and Push Through Challenges

Challenges and setbacks are inevitable, but maintaining high energy levels and a positive attitude can make all the difference. So, how do you keep that drive alive even when things get tough? First, set clear, achievable goals and regularly remind yourself of them. Break your larger goals into smaller, manageable tasks. Celebrate each small victory to keep your motivation high. Next, surround yourself with positive influences. Engage with colleagues who inspire and support you. Avoid negative environments that can drain your enthusiasm.

Also, take care of yourself physically and mentally. Regular exercise, a balanced diet, and adequate rest can boost energy and resilience. Lastly, keep learning and adapting. Stay updated on industry trends and continuously refine your skills. This not only helps you stay ahead of the competition but also keeps your interest and excitement alive.

Put These Strategies into Action for Better Sales

To truly see the impact of the strategies we’ve discussed, you need to put them into practice. These steps are designed to transform your approach and increase your insurance sales. But remember, understanding the strategies is just the start. The real magic happens when you implement them consistently.

If you’re looking for more personalized guidance or want to take your sales strategy to the next level, don’t hesitate to reach out to us at Sales Ninja Group. Our expert team is here to help you develop effective strategies tailored to your specific needs. Let’s work together to achieve your sales goals!

Leave A Comment